@JCRyle I preached on the impact of missionaries in India:

@wendelltalks When I was conceived doctors declared me as dead baby because there was no movements. My mom didn't give up. She walked to a near-by St Jude church everyday. I was named after him I recounted it as part of my eulogy for my mother:

@TomFrankly I use chatgpt to study the Bible. I see this bias. More here:

Focus all your attention on the thing that you're probably more talented at than picking stocks

Tech & markets change second by second Human behavior barely budges millennia by millennia If your edge is arbitraging human behavior, you're probably going to do well

TAM for "technological leapfrogging" legacy companies are too small for VC funded companies but they are still large for PE (or may be small biz & AI vibe coding entrepreneurs?)

There are still companies running their biz on pen & paper (or using Excel) rather than CRM, ERP etc. even though these have become very common. Same will happen with AI Lot of new solutions will come out. But there will still be ton of business which will be run with old soln

Without proper financial knowledge and understanding UBI kind of programs won't reduce wealth inequality.

If your investment portfolio earns more than you, is your job a side hustle?

At level 5 & 6, non-financial things get amplified. If you work all the time and you talk only money with kids, your relation with them is going to be transactional.

At every wealth level, something gets amplified At level 1, bad luck gets amplified You get a flat tire, you don't have money to fix, you can't get to your job, and you lose your job. It is always a downward spiral.

Legacy = action x wealth What you do with all the wealth defines your legacy. ⇒ Wealth amplifies intent (it can also be about time; open source code; or someone planting trees to make a forest)

Can you avoid getting onto anxiety treadmill as you add more wealth? May be this is linked to earlier point about increase in wealth vs increase in happiness?

Disagreeableness is a requirement to build outsized impact (on any factor of life - wealth, business ...)

What you do to get from 0 to 50 is very different from what to do to go for 80 to 90. Genius doesn't understand itself. We will say less than what we know. So don't ask them for advice

They are only 5% of them. Less than 10k people. The way they behave might not be a value to you at all. In fact, it might be destructive.

Don't take advice from people who are so far ahead in path. If you are on level 1 of wealth ladder, don't take advice from those in 6th level

They have an internal locus of control They don't confirm They're persistent

Top 2% are psychologically and in behavior very different than the vast majority of people They've delusional self-confidence They give wider error estimates (probabilistic thinkers) They're low in agreeableness (comfort with conflict) They love risk

Volume of outgoing calls has to triple during market volatility When mkt is down 40% you don't want to call up Bob & say, how are you doing? But that's exactly what you need to do. Be with the clients when things go wrong.

Successful investors do not comply with human nature. They defy it.

Assets that look the least risky in the short-term (UST bill), are the most risky in the long-term. You invest a buck in T bills back in 1927, it's worth about a 1.80 today. Inflation adjusted, the same dollar in equities is like $500 (approx; could be more)

The best "worst case outcome" for your investment is keeping pace with inflation. Many do worse than that (like if you held cash for a 10 year period)

If you are a 1st generation wealth builder & have a large portfolio in stocks, you might make more in a day than what you earned in a year when you started your career.

Atypical results require atypical actions

Happy man lives in a happy world Sad man lives in a sad world Angry man lives in an angry world

If you are poor, more income will make you happy If you are happy, more income will make you happy If you aren't poor and not happy, more income won't do a thing ⇒ Happy people are happy (with or without more income)

What about study about happiness stays flat after $75k Not true Ref:

To really change your lifestyle, you need like a 10x jump in networth If you've a million, an extra million won't change your lifestyle and so happiness. But a 10x more will change your lifestyle & happiness

You can read / watch here:

@venkat_fin9 oh very similar thing happened with me for my son. My son got influenza; GK Naidu hospital (cbe) said he has to be admitted; he was in hospital for 5 days. I submitted multiple "justification" from hospital to Lombard insurance. All rejected Paid from pocket

@iampawan31 @x_rahulraj Southern states controlled population well. Now they are going to lose their representation in the parliament. Do you think they will be ok with any more population control?

@AxisBankSupport Which part of my message you don't understand? Stop calling minors to sell your investments.

@krkeshav00 @sandeep_PT How many know about Kattabomban, Velu Nachiyar? Not a king, but how many know about VO Chithambaram And many others who might be celebrated in a region (Pazhassi Raja) but not outside; And like Tipu (fought British; but current gen don't want to recognize)

@patkua @mipsytipsy @JHaughwout @krider2010 @themaninblue @METR_Evals Thank you Pat. Is there any way to look at what was included?

@david_perell Ancient Tamil literature - Thirukural says this: The wound caused by fire will heal within, But not the scar left by the tongue.

You can read the edited transcript of the talk here: 11/11

Responsible AI is not a checkbox. It’s culture. And like all culture shifts, it needs leadership, repetition, and cross-functional effort. 10/11

Responsible AI ≠ perfect AI It means mature systems, clear policies, and real-world awareness. You won’t fix foundational issues. But you can build responsibly at the application layer. 9/11

Apply RMF again: 🗺️ Map: what can it say? where’s the data from? 📊 Measure: who’s asking what? token usage? risky replies? 🔧 Manage: alerts, logs, response controls 📋 Govern: review cycles, RACI, incident playbooks 8/11

External AI apps (chatbots, sales tools)? Different ballgame. Now you're facing customers. So governance must go deeper. Example: a chatbot should be clear if it's answering from a KB vs internet. 7/11

Internal AI usage (employee tools, SDLC copilots, etc.): ✅ Usage policy ✅ Tool whitelist ✅ Training & repetition ✅ Feedback loops between engineers and CXOs Keep it lightweight, but intentional. 6/11

But that doesn’t mean we throw up our hands. We apply the NIST AI Risk Management Framework (RMF): • Map • Measure • Manage • Govern It works for both internal and external use cases. 5/11

Most of us are building on shaky foundations. OpenAI, Claude, Perplexity—they all use datasets we don’t fully control or understand. You can’t guarantee fairness or privacy when you don’t know what went into the model. 4/11

It’s like asking an Indian exec: “Should we bribe?” Everyone says no. Then ask: “Have you bribed?” Most say yes. Welcome to the real-world tension between principle and practice. 3/11

In theory, Responsible AI sounds great. • Fairness. • Explainability. • Transparency. But when you’re racing to ship GenAI apps, ideals often crash into growth goals. 2/11

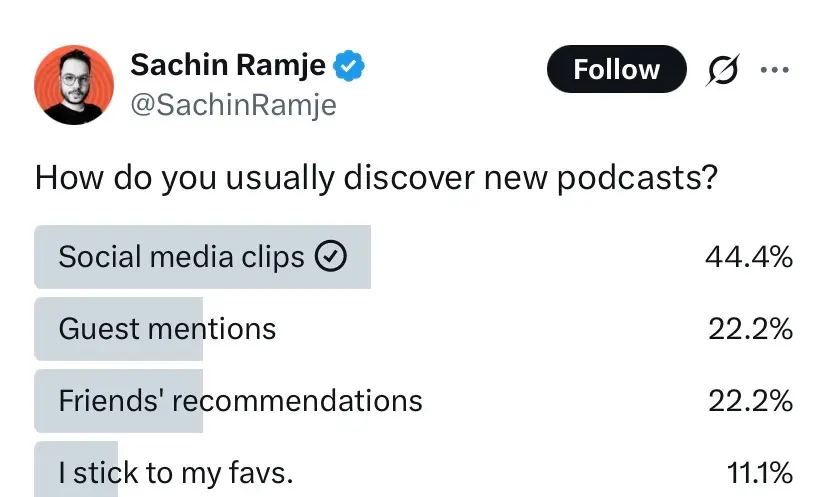

@SachinRamje Interesting. How will you interpret the poll results then? I interpreted to say I shud use more clips since it helps people to discover podcasts